- Category: February 2012 - Mobile Marketing

According to IDC, the enterprise applications (EA) software market experienced good growth of 18.6% year-on-year in the Asia Pacific excluding Japan (APEJ) region in 2011.

According to IDC, the enterprise applications (EA) software market experienced good growth of 18.6% year-on-year in the Asia Pacific excluding Japan (APEJ) region in 2011.

“Although the need to extend newer functionalities and capabilities to end-users, which in turn help in improving internal efficiencies and reducing operating cost, has been driving growth over the past 18 months or so, companies will take a cautious approach on software investments in 2012 due to the negative economic scenario,” says Sabharinath Bala, Research Manager of IDC’s Asia Pacific Enterprise Applications Software Research Group.

Notes:

Countries covered in IDC's Asia/Pacific Semiannual Enterprise Applications Tracker include Australia, New Zealand, Korea, India, the PRC, Taiwan, Hong Kong, Singapore, Malaysia, and Thailand.

Software revenue consists of license, maintenance, and other software revenue.

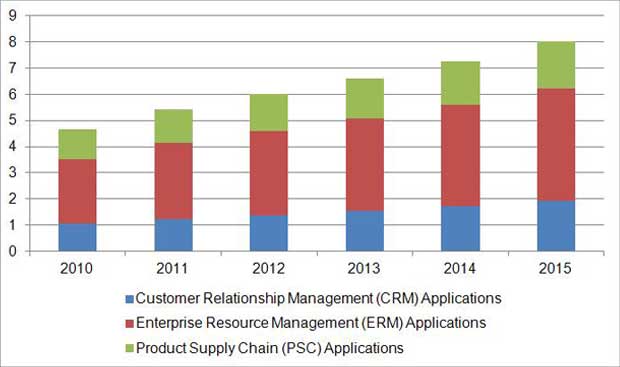

Enterprise applications include enterprise resource management, customer relationship management, product supply chain management.

On the other hand, technology trends like cloud computing, mobility, analytics, social media, as well as the regulatory and compliance environment do not give organizations much of a choice, but to invest in new software or upgrade their existing software to accommodate these trends and remain competitive and compliant in the marketplace. Vendors, therefore, will have to focus on delivering core value propositions for faster time-to-market, positive ROI, and business process improvement, rather than just concentrating on factors like innovation, deployment flexibility, and platform integration.

Key points from IDC’s study included:

- Owing to critical demands of the business environment, most of the top tier vendors are adding vertical-specific applications to their portfolio, either through organic development by incorporating industry-specific functionalities to their existing horizontals offerings or inorganically by acquiring products from niche vendors.

- Software-as-a-Service (SaaS) deployment of enterprise applications will gain traction, with small and medium enterprises opting for SaaS based offerings due to the low cost of deployment. This increased adoption of SaaS EA will cannibalize traditional on-premise deployments, but comparatively the overall size of the SaaS market will still be small.

- Vendor consolidation will continue, due to the eagerness of tier-1 vendors to acquire niche products and capabilities that will fortify their product portfolio. The drivers for vendor consolidation include technology trends like cloud, mobility, and socialytics.

At the secondary market level, the enterprise resource management market saw a minor increase in percentage share in the first half of 2011 and stood at 52.1% as compared to 51.6% in 2010, while there was a slight decline for product supply chain applications; customer relationship management market remained flat when compared between 2010 and 2011. Although not the biggest contributor to the overall market, enterprise asset management applications experienced the largest growth and manufacturing applications the least growth on a year-on-year basis among the functional markets. (Source: IDC)

By MediaBUZZ