- Category: October 2012 - Content Marketing

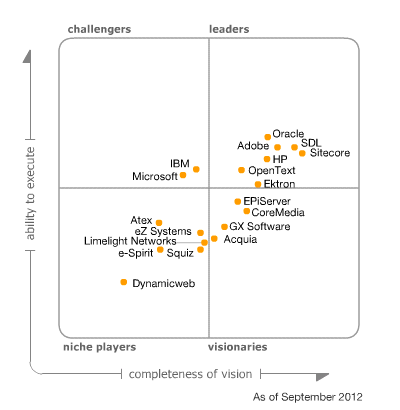

Last month Gartner published their Magic Quadrant for Web Content Management (WCM), which reveals that three trends have altered the web content management market since 2011: social media, mobile computing and the inclusion of WCM in more comprehensive solutions oriented toward online channel optimization.

Last month Gartner published their Magic Quadrant for Web Content Management (WCM), which reveals that three trends have altered the web content management market since 2011: social media, mobile computing and the inclusion of WCM in more comprehensive solutions oriented toward online channel optimization.

Buyers are looking for different capabilities and are changing how they buy WCM products.

Gartner states that the web content management market consists of commercial, open-source and hosted applications, based on a core repository, that control content to be consumed over one or more online channels.

Product functions go beyond simply publishing Web pages to include:

- Content creation/authoring functions, such as workflow and change management;

- WCM repositories that contain content and/or metadata about content;

- Library services, such as check-in/check-out, version control and security;

- Content deploy

- A high degree of interoperability with adjacent technologies such as CRM (in particular with marketing resource management and multichannel campaign management), digital asset management (DAM) and Web analytics;

- Real-time adaptation to visitor interactions through technologies such as delivery engines or enhanced frameworks for content delivery applications;

- The ability to integrate well with delivery tiers such as e-commerce, social media and portal software (not a requirement but a factor that weighs favorably)

Gartner excluded products such as portals and e-commerce engines, even though these technologies have overlapping functions.

Please, take a look at our article Gartner Evaluates Strengths and Cautions of Top WCM Solution Providers, where we have summarized the strengths and cautions Gartner identified in the Magic Quadrant.

The WCM Magic Quadrant divides vendors into 4 types:

Leaders (Oracle, Adobe, SDL, Sitecore, HP, OpenText, Ektron)

Leaders should drive market transformation and have the highest combined scores for “ability to execute’ and “completeness of vision”. They are doing well and are prepared for the future with a clear vision and a thorough appreciation of the broader context of online channel optimization (OCO). They have strong channel partners, a presence in multiple regions, consistent financial performance, broad platform support and good customer support. In addition, they dominate in one or more technologies or vertical markets. Leaders are aware of the ecosystem in which their offerings need to fit and can:

- Demonstrate enterprise deployments;

- Offer integration with other business applications and content repositories;

- Provide a vertical-process or horizontal-solution focus.

Challengers (IBM, Microsoft)

Challengers are solid vendors today and can perform well for many enterprises. The important question is whether they have the vision to succeed tomorrow. A Challenger may have a strong web content management (WCM) product, but a product strategy that does not fully reflect market trends, such as the increasing importance of the user's context, multichannel output and interoperability with adjacent technologies - for example, CRM, digital asset management (DAM) and multichannel campaign management.

Visionaries (EpiServer, CoreMedia, GX Software, Acquia)

Visionaries are forward-thinking and technically focused. For example, their products may have unique multilingual capabilities or set the market's direction through their innovation and product development. To become leaders, they need to work on some of the core aspects of their offerings and increase their ability to execute. They may need to build financial strength, functional breadth, service and support, geographical coverage, or sales and distribution channels. Their evolution may hinge on the acceptance of a new technology or on the development of partnerships that complement their strengths.

Niche Players (Atex, eZ systems, Limelight Networks, e-Spirit, Squiz, DynamicWeb)

Niche Players focus on a particular segment of the market, as defined by characteristics such as size, industry and project complexity. This narrow focus can affect their ability to outperform or to be more innovative. Niche Players often support only those applications that apply to the particular segments on which they focus.

Inclusion and Exclusion Criteria

Gartner determined which vendors to include on the basis of the following criteria:

- Revenue: The vendor's total WCM software revenue (including new licenses, updates, maintenance and subscriptions, SaaS, hosting and technical support) for the calendar year 2011 must exceed $11 million.

- Geographic presence: The vendor must have been in business for more than five years, with a multi-geographic presence for at least one year, and a strategy that supports further geographic expansion. It must actively market its WCM offering in at least two major regions, such as North America and EMEA.

- Vertical and horizontal capabilities: The vendor must actively market its products in more than two major vertical markets and in more than one horizontal application category (such as e-commerce and customer self-service).

- Market interest: The market must be interested, as evidenced by marketplaces, community forums, books, seminars, and the activities of partners and channel organizations (IT services firms, system integrators, distributors, web interactive agencies and advisory firms).

- References: The vendor must have WCM software commercially available and reference customers that use the software in production scenarios. Some of these customers should be of enterprise scale, with the number of contributing authors exceeding 50 and the average monthly number of page views comfortably exceeding 500,000, though we prefer deployments to support even larger numbers of users.

The functions that make WCM effective today differ from those that mattered most when WCM primarily served the operational role of feeding content to websites. Today, WCM products need to work with a wide and growing range of content types and must also support the enterprise's efforts to engage employees, customers and partners via mobile devices. And last but not least, WCM products have to work with a wider range of systems such as analytic applications, e-commerce platforms, database management systems and so on. As a result of these trends, many IT leaders have to upgrade or replace older WCM systems with new technology that can handle more complex and critical tasks. (Source: http://www.gartner.com/technology)

By Anjum Siddiqi