- Category: July 2021 - Mobile Marketing & Analytics

Due to the pandemic and the resulting restrictions, the sale of goods and services is shifting significantly to the Internet. And when shopping online, there are usually various payment options to choose from, such as invoice, direct debit, credit card, or online payment services such as PayPal.

Due to the pandemic and the resulting restrictions, the sale of goods and services is shifting significantly to the Internet. And when shopping online, there are usually various payment options to choose from, such as invoice, direct debit, credit card, or online payment services such as PayPal.

Some people prefer to use their credit card when shopping online, others like e-wallets better or paying on account. What unites in terms of payment methods is the need to offer customers a broad mix of payments in the future. Because in addition to the three payment methods mentioned, online transfer, debit card, mobile payments, installment payments or prepayment are popular, too. The fact is, that a purchase is often canceled at the check-out because the preferred payment method could not be selected, which points out that regional needs should be considered in the payment mix as well.

Common e-payment complaints

Anyway, paying with digital services is quick and easy and the number one reason why they are so popular. But of course, the more such services are used, the more problems are reported in connection with online payment. For example, claims are being collected even though the goods never arrived or have long since been sent back. Consumers complain that they have to deal with the payment processor in addition to the merchant to get their money back. Fraudsters have also discovered online payment services for themselves and shop without the knowledge of the consumer at their expense. The consumers who were cheated out of their money report that they then struggled to get the money back from the payment services. The most common complaints are related to billing and collections, unfair business practices, contract terms and termination. These are not new problems, but with the online shopping boom during the Corona period, these problems are becoming more visible. And don’t forget that with the selection of a payment provider, the merchants enter into technological dependencies. Once the sales channel has been established, it becomes difficult in terms of time and money to switch. So, the decision should be carefully considered.

International transfers in real time, super apps as service platforms with own payment functions and cyber wallets are reality by now. In fact, according to the study Payments 2025 & beyond by the auditing and consulting firm PricewaterhouseCoopers (PwC), cashless transaction volumes are expected to increase by more than 80% to 1.9 trillion in the next 5 years, and the number of digital payments per person is believed to almost triple by 2030.

Super apps point the way

The study verifies as well that the corona pandemic has accelerated the switch from cash to digital payments by years and has fundamentally changed the entire payment traffic infrastructure.

With the emergence of new payment methods and innovative business models, the scenario of a global cashless society is within eyeshot.

The strongest growth is expected for the Asia-Pacific markets, where cashless transaction volumes are forecasted to increase by 109% till 2025 and by an additional 76% from 2025 to 2030.

While numerous new business models and innovations such as multifunctional “super apps” from large e-commerce groups or QR codes for supermarket shopping are already being used in Asia, the pace of innovation is much slower in Europe, North and South America. At least the acceptance for mobile payment is increasing there too.

Macro trends for digital money and wallets

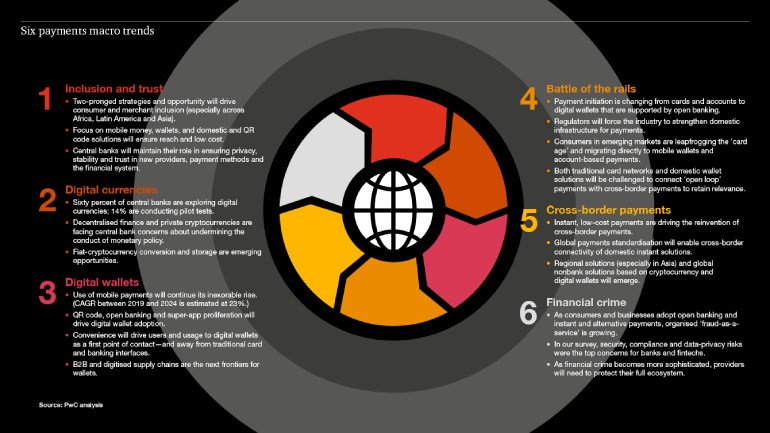

The entire infrastructure of payment systems worldwide, including the business models of the market players, are about to take a quantum leap, the study states. Six macro trends will have a major impact on payments over the next five years. These include digital currencies, digital wallets, and cross-border payments.

For this reason, all players in international payment transactions should now invest more in competitive payment solutions, such as e.g.:

- Paying with wearables – communication APIs offer fast and smooth customer interactions, and contactless payment with smartphones or smartwatches is popular, too. Services such as Apple Pay or Google Pay, for instance, enable this type of payment that require secure identification, therefore biometric device authentication has long been part of everyday life here.

- Paying with a QR code is e.g., already omnipresent in China. The WeChat B2B platform can be used for this purpose, which is why for many Chinese companies, a WeChat profile is more important than a website. Particularly popular is the use of QR codes in online and offline marketing, like flyers: you can easily add new accounts / companies and friends, advertise campaigns, pay for the taxi, or even donate to a street musician.

- Livestream shopping is another megatrend from Asia that promises enormous sales potential. The new format is particularly popular among the younger age-group in Asia. Solutions from Instagram, Facebook, and Co, for instance, stream products several times a week and customers can shop directly.

- Cryptocurrencies and use of blockchain-based payment for parking fees have been tested by Porsche in 2019 for the first time: this includes that the car pays all fees for parking or the tolls from machine-to-machine (M2M) independently; each transaction is stored securely, decentralized, and encrypted in a blockchain on many servers (nodes) at the same time. The nodes monitor each other, therefore a blockchain does not need an intermediary to offer security.

- 5G and augmented reality (AR) provide completely new possibilities and change the shopping experience significantly. In combination with augmented reality, shopping becomes even more personal.

By Daniela La Marca